Exchanging assets sounds simple. The process involves a method of payment, noting the amount paid, checking a statement periodically, and of course end of year taxes. The process sounds simple. For those of you who are movers and shakers in your community, as your assets grow, so does the process.

To individuals, assets may be their home, savings account, investments, gun collection, etc. These items appreciate in value. Other individuals consider their assets to be their truck, boat, ATV, or music collection. People, these items are not assets. An asset is something that will make you money. Either way, it does not matter for individuals. For individuals, assets (real or not) cost you money. Assets make you money. I use to have horses, now I have cattle. Horses cost me money. Cattle make me money.

Keeping track of expenses is different for businesses than individuals. Business expenses are deducted from gross income, thus not taxed. However, in a business, not all purchases are considered expenses. Many times the asset, cash, is exchanged for the asset, inventory. Inventory is not an expense. Not until inventory is sold should the expense be taken. Remember the matching principle? For proper recording of financial transactions, income must be matched with expenses.

So, if expenses are not taxed, is it beneficial for businesses to expense purchases immediately? Remember, businesses should follow GAAP, thus inventory is not allowed to be expensed. Also, it is beneficial to the balance sheet to show assets (inventory is an asset).

Individuals and businesses both buy in bulk when they can. Storage is an issue but price and convenience leans towards bulk. Remember economies of scale? In other word, money talks. When merchants do not offer a volume discount, it is still convenient to bulk buy.

When an individual bulk buys, the expense is taken immediately. When businesses bulk buy, a portion may be expensed, but the majority goes into inventory. Inventory involves keeping up with assets. Every reporting period should include asset beginning balances, ending balances, and the computing of assets used. Assets used are re-entered into the accounting records as adjustments or Cost of Goods Sold (COGS), and expensed.

Many assets go down in value with age. Thus when recording COGS, the lower of Cost or Market is to be applied. Market value is a very subjective number to determine, but it is not hard to determine if market value is greater than or less than the original cost. When greater than, the actual subjective value does not matter, use the actual cost. When less than, GAAP say to go with a conservative subjective value.

This people, is why we have accountants. The overall process is simple, but as the assets increase, so does the amount of paper work. The business managers should focus their time managing their employees and bringing in cash. Let the accountants manage the record keeping.

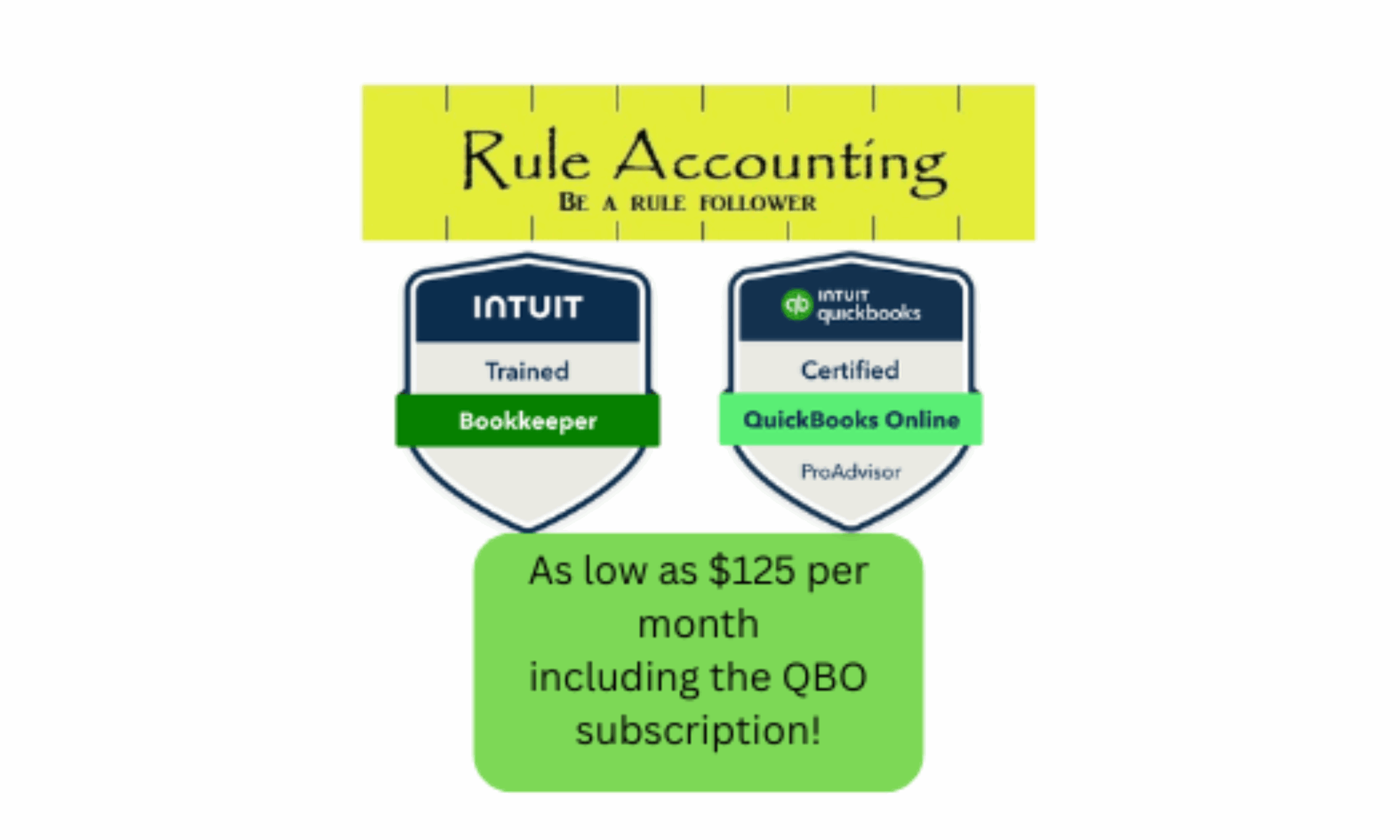

A quick plug for my business, Rule Accounting. If your business is starting to takeoff, but you may not be able to justify a full time accountant, let us help you. With the internet, we are able to assist you from anywhere. We can install an app on your smart phone that will allow us to get data from you, either daily, weekly, or monthly. If you prefer to collect the data yourself with Excel, Quicken, or QuickBooks, we may exchange files. Collecting the data is easy. Knowing what to do with the data is a matter of knowledge and experience. That is where Rule Accounting can help.

Brett Bickham, Clifton, TX

Sept. 10, 2018

Owner, Rule Accounting