Keeping track of assets sounds simple. The process is relative. Relative meaning it depends what assets you are tracking. Assets include cash, cattle, feed, equipment, and other items which will make you money. In other words, a return on your investment. Some of these items are definitely easier to keep up with than others.

Cash is a relatively easy asset to track. The IRS uses W2’s and 1099’s. Banks and brokerage firms are heavily regulated to ensure your cash assets are reported to the IRS. You may go to an ATM machine and see your cash balance at any time. Some people still receive a monthly statement from their bank. The businesses and individuals who keep a register of their financial transaction always know their cash balance.

Cattle is a relatively difficult asset to track. Because of the difficulty to track cattle, the IRS and government regulations have avoided this asset, so far. Ranchers, on the other hand, need to keep up with their cattle because no one else will to do it for you. There are several reasons to track (manage) your cattle. First, the IRS. Second, you want to properly manage your cattle business. By doing the second, it will keep you out of trouble with the IRS and it will help keep you profitable.

Feed is also a relatively difficult asset to track. Some feed is self-grown and harvested. Other feed is purchased. Some feed is consumed by the ranch and other feed is sold. Of the feed consumed by the ranch, some is used to raise replacement cattle and some is used to maintain the cattle herds. Some feed is expensed when purchased. Some feed is expensed when used. Some feed is put into the asset account, Inventory. Some feed is put into the asset account, Work in Process.

Feeding cattle needs to be kept up with by groups such as weanlings, heifers, bulls, or cows. The head count and amount of feed fed each time should be noted. Feeding cattle is all about the cost per head, per day. The cattle cycle is 12 months or 365 days. $1.25 a day to feed cattle is $456 per head, per year. If you are selling calves for less than it cost you to feed the cow, you are losing money. The same rules apply to raising replacement heifers and bulls.

Cattle, like other assets, should be depreciated. Cattle produce a return over multiple years and the fundamental principle of accounting is to match income with expenses. For tax purposes, the IRS allows some items to be 100% expensed the very first year. That is great to lower your income for that year, but bad for the subsequent years and financial reports. Accounting for financial reports dictates depreciation to be done as accurately as possible. For cattle, depreciation begins when the animal reaches breeding age and is then depreciated evenly over the next seven years.

As all ranchers know, not all cows are kept for seven years. That further complicates tracking (accounting) of cattle. The following is per the IRS Tax Code: IRC 1012, Basis of property—cost. IRC 1016, Adjustments to basis. IRC 1245, Gain from dispositions of certain depreciable property. When you sell inventory cattle, there are three things you need to keep up with.

- Gain or Loss. Your gain is the amount realized less the adjusted basis.

- The adjusted basis.

- The holding period, or the time you owned the cattle.

This people, is why we have accountants. The overall process is simple, but as the assets increase, so does the amount of paper work. Ranchers should focus their time managing their cattle and bringing in cash. Let the accountants help to set up a record keeping system that works for your operation.

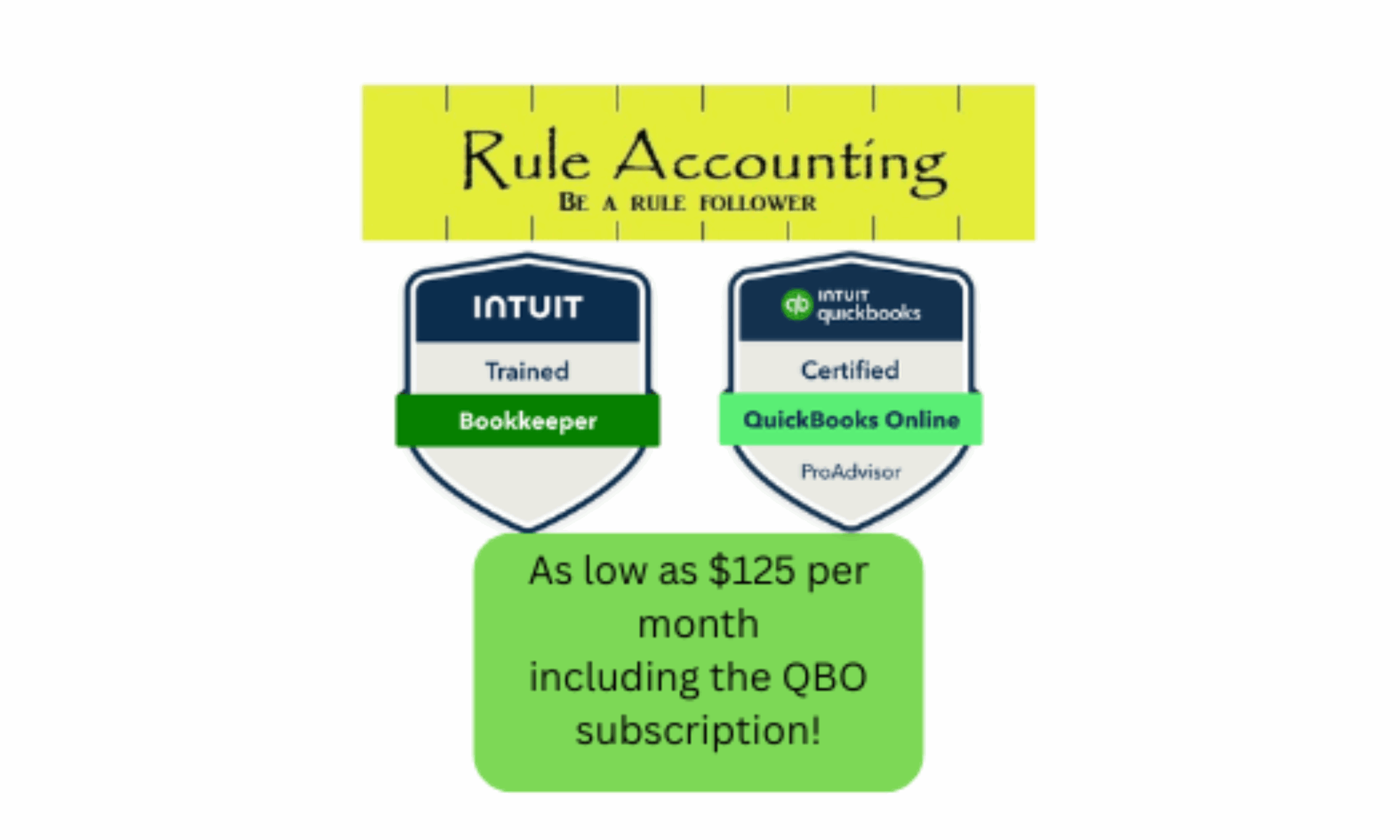

A quick plug for my business, Rule Accounting. If your business is starting to takeoff, but you may not be able to justify a full time accountant, let us help you. With the internet, we are able to assist you from anywhere. We can install an app on your smart phone that will allow us to get data from you, either daily, weekly, or monthly. If you prefer to collect the data yourself with Excel, Quicken, or QuickBooks, we may exchange files. Collecting the data is easy. Knowing what to do with the data is a matter of knowledge and experience. That is where Rule Accounting can help.

Brett Bickham, Clifton, TX

Sept. 15, 2018

Owner, Rule Accounting