I have been asking myself this question for years. How long should I keep my tractor or any other item I am depreciating? I am not alone in this question. This debate has been around for as long as accounting has been around. Well maybe not. Accounting began in the 15th century to aid merchants in European and Mediterranean countries. Florence, Italy was a mecca for international trade back in the day. About that same time was the shift from Roman numbers to Arabic numbers. Depreciating capital assets came later.

Equipment costs are significant to any business. The equipment costs are considered fixed costs, as opposed to the fuel to run the equipment are variable costs. Depreciation expense is a fixed cost. Per GAAP, Generally Accepted Accounting Procedures, Equipment must be expended during the periods used to generate income.

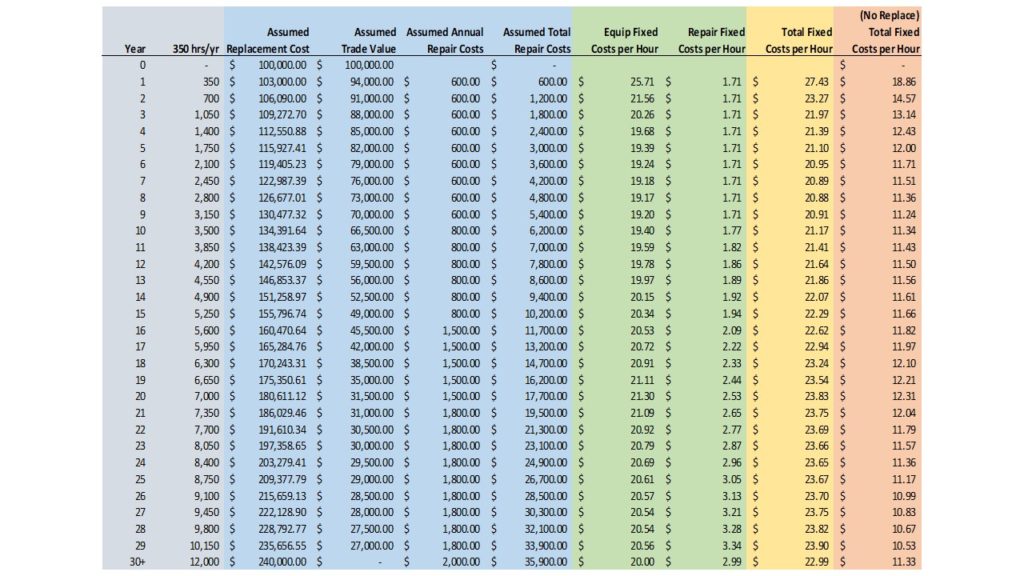

I am not going to include maintenance costs, as these are considered variable costs. Repair costs increase the longevity of the asset and thus, are depreciated. As stated previously, depreciation costs are considered fixed costs and are included in my analysis.

As we all know, a tractor may be used until it is wore completely out and left to rust away where it finally quit, or may be traded in on a new tractor. As your business grows, you may need to trade up to more horsepower.

So back to my original question, should I trade while my tractor is relatively new with lots of life left, trade midway through its life, trade toward the end of its life, or just run it into the ground? Of course, the longer I wait to trade, the less value the tractor has. This assumption is based on declining value. In accounting, land is the only asset that is not depreciable and is considered to increase in value over time. We all know lots of other assets hedge against inflation too, some tractors fall into this category.

So here is the dilemma. For every year I keep my tractor, the replacement cost increases, the trade-in value decreases, and cumulative repair costs increases. Remember, the total fixed cost is the equipment cost (difference between replacement cost and trade-in value) and the repair cost.

For my tractor the average fixed costs, per hour, is fairly constant at $23 / hour. The lowest fixed costs is $20.88 / hour and that is at 2,800 hours.

By trading to new equipment on a regular basis, the unknown repair costs and down time are eliminated. Some people only plan to stay in business for the life of their equipment. When the equipment dies, so does their business. For people that don’t intend to replace their equipment, their fixed cost is less, but loss of revenue due to down time, is greater. For part time business, downtime may not be an issue. For those of us in the hay business, downtime is critical.

Brett Bickham, 8/21/2019

Clifton, TX