Large public accounting firms now include CAS in their list of services. Here at RuleAccounting.com we also offer CAS as well as QuickBooks Online Sales and Services.

Call or text for prompt service and quote. 254.978.0001

QuickBooks Online

Large public accounting firms now include CAS in their list of services. Here at RuleAccounting.com we also offer CAS as well as QuickBooks Online Sales and Services.

Call or text for prompt service and quote. 254.978.0001

Would you like someone to reconcile and clean up your books at the end of each month?

At year end, 1099s need to be filed to record the amounts paid to contractors over the year. If you use QuickBooks Online, this data is already in QuickBooks, you can save a lot of time by preparing 1099s in QuickBooks, or by having QuickBooks prepare them for you. QuickBooks can e-file for you saving a lot of hassle.

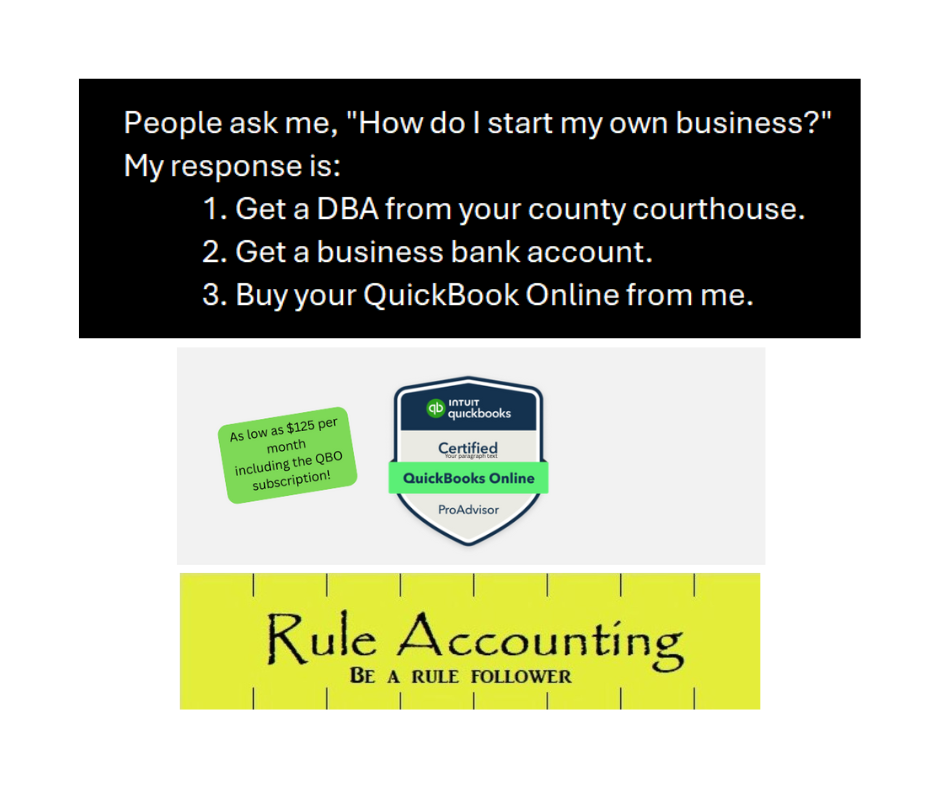

As a QuickBooks Online ProAdvisor, Rule Accounting can sale you QuickBooks Online and provide you with the technical expertise to assure you are doing your bookkeeping correctly. All of this, including the QuickBooks Online monthly subscription fee and my guidance for just $125.00 per month.

Buy your QuickBooks online from me and not only will you get a discount I will be able to assist you with any questions you have and also help you during your initial set up and monthly reviews. You will love this accounting software!

As a QuickBooks Online Pro Advisor, I am able to sell you the correct version you will need at a discounted rate.

I am personally proud to use and sell QBO! This is an amazing full accounting software package.

Lawsuits are to be expected in a company with 3,000 employees. WIND, like all other contractors, had to sign “hold harmless” agreements with Dow Chemical and all the other chemical companies they did business with. Hold harmless agreements released Dow from any liability, Dow’s fault or not, should an accident occur.

When working in a chemical plant, gas leaks happen weekly. Most gas leaks are minor and repaired before any severe injury. Some leaks were due to faulty material. Scrapped off paint and the salt air, coupled with a corrosive environment of chemical plants, will cause a hole to develop in the pipe. Other leaks are caused when the operators are unplugging a process line.

Excerpt from my novel, “Windfall”.

Available on Amazon.

Jake had viewed a video once of a ball girl scaling the back corner left field wall and catching a foul ball. The highly paid left fielder didn’t even try. Jake admired people with gumption.

Excerpt from my novel “Windfall”.

Available on Amazon.

WIND paid their material suppliers promptly and they knew it. Vendors fought for WIND’s business. Graft and corruption were rampant in the 1980s. Lunches were daily. Hunts and fishing trips were seasonal. $20,000 bulls were purchased with every half million-dollar order.

Excerpt from my novel “Windfall “.

Available on Amazon.